Services and Fees

Our approach

You want to know what we do and what we charge, that's completely reasonable.

We believe in charging a fair fee for the work we do. For this reason, we echo the transparency of our approach and disclose our fees online.

Before we get to this, we have a 3 point promise designed to give you confidence in our service and how we charge.

Now we've explained that, our planning and advice services and the associated fees work as follows.

Initial Meeting

This meeting costs you nothing. In this meeting we'll discuss your circumstances, how we can help, and what that might look like.

You'll come away from this meeting with a really good idea of whether we're the right people for you.

If we both agree that we think we can work together, then it's from this point on that we'll charge for the work we do.

It looks like this.

How it Works

We follow a three step journey to help you with whatever financial matters you need help with now.

Every year we renew and review things, which is the fourth step.

Understand

👂We take the time to really get to know you. Your hopes, fears, plans and aspirations in life. We want to know where you are now and where you want to get to.

Plan

💻📝We then pull together all your financial information and build a visual financial roadmap, which shows where you are now and your projected future position. We can also look at alternative scenarios, so you can decide what to do next.

Advise

🗣️Next we recommend how to maximise your current and future position and help you put this in place.

Review

👥Everything is done for now. We then get together again, usually a year later, to review where you're at, and recommend any tweaks to the plan if they're needed. Again, we'll help you make any changes required. This review process is an ongoing one each year.

What is the Value of Advice?

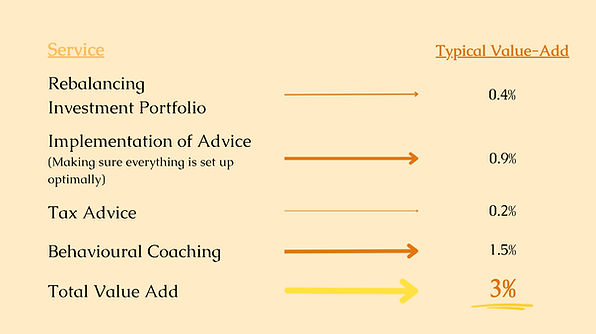

Research from one of the largest global investment groups, Vanguard, has quantified the value of advice, through research of financial planners and their clients globally.

They found that on average, a financial planner will add around a 3% return to a client's wealth each year, through everything that they do for them.

.jpg)

3% is huge when compounded year upon year, and half of this typical return is made up through behavioral coaching. Making sure you keep on track with your plan and making it work behind the scenes.

What Will it Cost?

Financial Plan

£3,250 - £4,250 as a fixed fee

We take half of this fee up front before starting work for you, and the other half after you receive your financial plan from us.

Implementation

£495

For a new pension or investment plan.

Can be for a lump sum contribution and/or regular contributions

For Protection Advice we will usually be paid a commission by the recommended insurer. Where appropriate we may recommend you pay us directly, but you will always have the choice.

For advice on:

-

Mortgages

-

Private Medical Insurance

-

Equity Release

We will recommend you to trusted partners who are specialists in these areas of advice.

On rare occasions, we may need to charge a higher implementation fee. If so, we will explain why and agree this with you.

An example why would be where there are multiple pensions - more than 2 - to advise on and consolidate.

Ongoing Planning & Advice

In most cases, we charge a fixed ongoing fee, with this typically ranging from £200 - 500 per month. Once we understand your position and the level of input you'll need from us, we'll tell you what this fee will be.

In some situations, it may be more appropriate for us to charge you through the investments and pensions you hold.

In these instances, we may charge on a percentage basis, with this being 0.8% of invested assets.

A note on regulation:

The Financial Conduct Authority (FCA) does not regulate certain aspects of cashflow planning (your financial plan), estate planning, tax planning or trust advice.

It does however regulate all product and investment recommendations we make, which are the services outlined below.

"Of those who took financial advice last year, 88% said it represented good value for money."

LangCat Consultancy Research - May 2023

https://www.flipsnack.com/langcat/the-advice-gap-report-2023.html