- Jamie Flook

- Dec 18, 2025

- 14 min read

Updated: 4 hours ago

You're a business owner with profits building up in your company, and you’re probably asking a simple question with no obvious answer:

“What’s the sensible thing to do with this money?”

The frustrating part is that most options sound reasonable: dividends, pensions, leaving money in the business. Yet very few business owners feel confident they’re choosing the right one for them, or right mix.

In this guide we explain your options, why some choices cost you more tax than others, and how to align profit extraction with your long-term financial goals.

This guide explains:

The real profit utilisation options available

When each option makes sense and when it doesn't

How profit extraction affects tax and personal wealth

Which strategies are typically most efficient for UK limited company directors and business owners

First, just like with your own personal finances, you always want to have a capital float for planned, and unplanned, large expenditures. That goes without saying for good planning.

So let's assume you have that in place, and that you don't need to re-invest in the business.

What do you do with the rest? and with the expectation that this will crop up again every year?

What Business Owners Are Asking Right Now

Here are the real questions we see directors asking:

“Do I need to take profits out of my company every year?"

“Should I pay myself more salary, or take dividends?”

“Is it better to invest profits inside the company or personally?”

“How do retained profits affect my long-term plan?”

“Why are pension contributions one of the best uses of profits?”

"My accountant says I should use my profits, but how?"

We know from the experience of working with our business owner and director clients that this people like you usually fall into one (or more) of these groups:

Profits are building up faster than personal spending needs

Income is comfortable, but long‑term wealth feels vague

The business is doing well, but you’re overly dependent on it

You’re trying to be tax‑efficient without creating future problems

If those sound familiar, this article is for you.

Quick Answer: What Most Directors Should Do With Company Profits

You have four main options:

Leave profits in the company as retained earnings

Save business cash in a deposit account

Invest in corporate-level or personal investments

Use profits for tax-efficient pension contributions

Let's take each in turn.

So now we know this, let's talk strategy.

Option 1 - Keeping Profits in the Company - Pros and Cons

Leaving profits in the company simply means keeping them as retained earnings rather than extracting them immediately.

🔍 What Happens

Your company pays Corporation Tax on profits (currently up to 25% depending on profit levels).

The remaining amount sits in your company bank account.

✔ Pros

Immediate access for business needs Retained profits provide flexibility for growth, hiring, investment, or unexpected costs.

No immediate personal tax You avoid income tax or dividend tax until money is extracted.

Supports business stability Holding cash reserves can strengthen the balance sheet and reduce financial stress.

Useful for short- to medium-term planning Especially effective if profits may be needed in the business in the near future.

Can support business sale planning Retained profits may form part of exit planning if a sale is expected.

❌ Cons

Corporation tax is still payable Profits are taxed before being retained, reducing the amount available.

Money sits idle Cash held in the company will lose value over time due to inflation.

Increased dependency on the business Your personal wealth remains tied to the company’s success and risk.

May complicate long-term planning Excess retained profits without a clear strategy can lead to inefficiency or poor decisions later.

🟢 When this works well

When the business genuinely needs capital for growth, resilience, or planned future investment.

When personal income needs are already met and there is no immediate requirement to extract funds.

When retained profits are being held for a clearly defined purpose rather than by default.

When short‑term tax deferral is intentional and part of a wider, reviewed strategy.

When personal wealth planning exists separately and retained profits are not relied on long term.

When you plan to sell in the near future and know that you can benefit from Business Asset Disposal Relief at a lower tax rate than extracting the profit another way.

🟠 When this can cause problems later

When retained profits quietly become the main long‑term wealth strategy without a clear exit plan.

When cash builds up well beyond what the business realistically needs, concentrating risk unnecessarily.

When future tax on extraction is deferred without understanding how or when it will eventually be paid.

When access, flexibility, or personal independence becomes more important than short‑term tax efficiency.

When profits have accumulated through inertia rather than deliberate, reviewed decision‑making.

Option 2 - Putting Retained Profits in Deposit Accounts to Get Interest - Pros and Cons

If you don’t want to take money personally but want a return on cash, you can put surplus profits in business savings/notice accounts.

🔍What Happens

Your money earns interest tax-efficiently inside the company.

✔ Pros

Keeps cash accessible and liquid Funds remain available for business use if required.

Earns a return on idle cash Better than holding excess funds in a current account.

Low risk Capital is typically protected (within banking limits). This is now £120,000 per institution. For example, a business account with Lloyds Bank with £200,000 held would have £120,000 protected, in the event of Lloyds being unable to give your money back.

Simple to manage Requires minimal ongoing oversight or complexity.

Useful as a temporary strategy Ideal while you decide on longer-term profit deployment.

❌ Cons

Corporation tax applies to interest earned Interest income is taxed within the company.

Returns may not beat inflation Especially in real terms over the long run.

Still trapped inside the company Personal tax will apply when money is eventually extracted.

Not a long-term wealth strategy Cash savings rarely support long-term personal financial independence.

Can delay better planning decisions Parking cash for too long can lead to missed opportunities.

🟢 When this works well

When the money is genuinely short‑term, needed for liquidity, or earmarked for a known future business use.

When protecting capital and maintaining easy access matters more than long‑term growth.

When holding cash forms part of a deliberate risk‑management or contingency strategy.

When interest income is viewed as a temporary holding return rather than a wealth‑building solution.

When inflation risk and post‑tax returns are understood and regularly reviewed.

🟠 When this can cause problems later

When large cash balances are left in deposit accounts for long periods with no clear plan.

When interest earned fails to keep pace with inflation, quietly eroding real value over time.

When cash becomes a default parking place for profits rather than a strategic decision.

When reliance on deposits delays more suitable long‑term planning for surplus profits.

When the role of company cash in personal long‑term wealth planning is unclear.

This is often a good interim strategy while you decide how to use the profits longer term.

Why might you decide on option 1 or 2?

Some business owners intend on leaving excess profits in the business, and then plan to withdraw the cash when they sell the business, and benefit from a reduced 14% Capital Gains Tax rate, due to Business Asset Disposal Relief (BADR), which used to be known as Entrepreneur's Relief.

BADR used to be 10% for many years, but BADR is 14% at the time of writing (December 2025) and will be rising to 18% from April 2026. This means this option is less attractive from a tax-efficiency point of view, but it may still be right for you.

If you do go down this route, you still need to decide what you will do with the cash in the meantime. Realistically you should be aiming for that money to keep place with inflation to retain it's long term value.

The impact of inflation eroding your capital is very real, particularly if you look over longer time horizons.

Option 3 — Investing Through the Company - Pros and Cons

You can invest company profits in corporate investment vehicles, such as:

Stocks and shares portfolios

Commercial property

Other business assets

🔍What Happens

Instead of extracting profits personally, your company can invest surplus cash directly.

✔ Pros

Keeps money working instead of sitting in cash Investing company profits can help offset inflation and improve long-term returns.

No immediate personal tax You don’t trigger income tax or dividend tax at the point of investment.

Maintains liquidity and flexibility Investments can often be sold if cash is needed in the business.

Useful for medium-term planning Particularly effective if you expect to extract funds later or sell the business.

Can support exit planning Retained and invested profits can enhance business value if structured correctly.

❌ Cons

Corporation tax still applies Profits are taxed before being invested, and investment income may be taxed again.

Investment gains may affect tax reliefs Holding investments can impact eligibility for Business Asset Disposal Relief (BADR).

More complex tax treatment Dividends, interest, and capital gains inside a company are taxed differently and require careful planning.

Money is still “trapped” in the company You will eventually pay tax again when extracting funds personally.

Higher risk if poorly structured Investing inside a trading company without advice can create unexpected tax or regulatory issues.

🟢 When this works well

When surplus profits are genuinely long term and not required for day‑to‑day business use.

When investment risk is understood and aligned with the company’s wider objectives.

When investments are made deliberately rather than simply accumulating excess cash. If done right, dividends received by investments held in ltd co.s are tax-exempt, however gains are generally taxed when sold under Corporation Tax.

When the impact on future extraction, tax, and access has been considered.

When company investments form part of a broader, reviewed strategy rather than a standalone decision.

🟠 When this can cause problems later

When investments inside the company become a proxy for personal long‑term wealth planning with no thought to how you'll get it out to use the money personally when needed.

When access to capital is restricted at times when personal flexibility becomes important.

When investment risk is taken without fully understanding the tax consequences inside a company.

When changes in business circumstances force investments to be sold at an inconvenient time.

When the long‑term implications for exit, retirement, or succession haven’t been thought through.

Investing inside the company can allow you to grow profits before extraction. But be careful, investment income retained in a company may be taxed differently, and gains may attract additional tax depending on structure and timing.

You can also invest outside of the company, and in some cases we recommend clients do this, to diversify risk away from the business. You can read more about this here: https://www.labfp.co.uk/post/business-owners-how-to-save-tax-grow-your-wealth-and-reduce-risk

Option 4 — Use Company Profits for Pension Contributions - Pros and Cons

🔍 What Happens

Your company uses surplus profits to make employer pension contributions on your behalf.

✔ Pros

Reduces corporation tax Employer pension contributions are usually an allowable business expense under the “wholly and exclusively” rule.

No income tax or National Insurance Unlike salary or dividends, pension contributions are not taxed on the way in.

Moves money out of the company tax-efficiently You extract value without triggering personal tax.

Builds long-term personal wealth Pension funds provide compound growth in a very tax-advantaged environment.

Assets are outside your estate for IHT until 2027 Pensions are typically protected from inheritance tax, but after 2027 they will be included in your estate.

Excellent for long-term and exit planning Pensions help transition wealth from business dependence to personal financial independence.

❌ Cons

Money is locked away until pension access age Currently 55 (rising to 57 in 2028), which limits short-term flexibility, unless you're already above this age.

Annual Allowance limits apply Typically £60,000 per year, although carry forward can increase this.

Requires forward planning Over-funding without considering future income needs can be inefficient.

Not suitable if you need cash personally today Pensions are a long-term strategy, not a short-term cash solution.

Rules and allowances can change Pension legislation evolves, sometimes becoming more generous and sometimes less.

🟢 When this works well

When pension contributions are used deliberately as part of a long‑term wealth strategy.

When allowances are understood and contributions are planned rather than ad‑hoc.

When tax efficiency is balanced with a clear understanding of future access and income needs.

When pensions form one component of a diversified personal wealth plan.

When contributions are reviewed regularly as business profits and personal goals evolve.

🟠 When this can cause problems later

When pension contributions are driven solely by tax relief rather than long‑term suitability.

When too much wealth becomes locked away without considering future flexibility or access.

When allowances or future tax rules are assumed rather than actively monitored.

When pension planning is disconnected from wider business and personal financial decisions.

When contributions continue out of habit rather than ongoing relevance.

Why might you decide on option 4?

Some business owners instead fund their pension as much as possible each year because it's tax-efficient and it diversifies away your own personal wealth from the business.

If you were planning on a nice big sale valuation when you come to retire, it's a lot stressful extracting the value you think you're owed, if you have a healthy pension to fall back on.

Each of the four outlined options can be sensible in the right context. The challenge is understanding how they interact, and which trade‑offs matter most for you over time.

If you’re like most business owners we speak to, you’re not trying to pay as little tax as possible, you’re trying to build a secure and bright future, have options when you sell, and can stop worrying about what happens to all the value you’ve built.

That’s exactly where tailored financial planning helps.

Want personalised numbers for you and your business?

Book a free profit-extraction strategy call here:

Let's play out the two different approaches/strategies with a business owner client of ours (name changed of course and no, that's not his picture either).

Patrick, is aged 45, and owns PR123 Ltd., a PR company, which make profits of £100,000 a year after all staff remuneration. He likes to take £40,000 dividends a year to top up the salary he pays himself.

Approach One & Two Compared

Approach | 1 (No Pension) | 2 (£50,000 into Pension) |

Pre-tax Profits | £100,000 | £100,000 |

Pension Contribution | £0 | £50,000 |

Corp Tax (at 22.75%) | £22,750 | £9,500 |

Dividend | £40,000 | £40,000 |

Retained Profits (left in company) | £37,750 | £500 |

What are the differences?

Patrick has more left in the business in Approach One, however, he's paid £13,250 more in Corporation Tax for the privilege.

In Approach Two, he has put £50,000 into his pension, hopefully to grow ahead of his retirement, plus left £500 in the business.

In both cases, he's taken out the dividend he wanted.

In approach 1, he receives total benefit (dividend, pension contribution and retained earnings) of £77,750.

In approach 2, he receives total benefit of £90,500.

What does the long-term picture look like?

After 10 years, he'll have put £500,000 into his pension in the pension scenario. He'll have paid £95,000 Corporation Tax (assuming corporation tax rates have remained the same).

In the no pension scenario, he'll have £377,500 in the business bank account, and paid £227,500 in Corporation Tax.

So on the face of it, leaving the money in the business is a bad idea.

But what about what compounding does to the money after 10 years, and what about the tax you would pay on getting the money out of the business, or out of the pension?

Let's look at two scenarios:

He leaves it as retained profits in the company, moves it around and gets a 3% interest each year in a business deposit account and takes the money out using BADR when he sells the company in 10 years' time.

He invests it in the pension and gets a 5% return each year.

Keeping Money in the Business (3% growth, BADR on exit)

Year | Retained Profits – No Growth | Retained Profits Pot (3% growth) |

|---|---|---|

1 | £37,750 | £38,882 |

2 | £75,500 | £78,931 |

3 | £113,250 | £120,182 |

4 | £151,000 | £162,670 |

5 | £188,750 | £206,432 |

6 | £226,500 | £251,508 |

7 | £264,250 | £297,936 |

8 | £302,000 | £345,756 |

9 | £339,750 | £395,011 |

10 | £377,500 | £445,744 |

BADR tax rate: 14%

Tax: £62,404

Net proceeds: £383,340

Making £50,000 a Year Pension Contributions (5% growth)

Year | Pension Contributions to Date | Pension Value (5% growth) |

1 | £50,000 | £52,500 |

2 | £100,000 | £107,625 |

3 | £150,000 | £165,506 |

4 | £200,000 | £226,282 |

5 | £250,000 | £290,096 |

6 | £300,000 | £357,100 |

7 | £350,000 | £427,455 |

8 | £400,000 | £501,328 |

9 | £450,000 | £578,895 |

10 | £500,000 | £660,339 |

Effective tax: 15% (Using a combination of tax-free cash and basic-rate taxable pension withdrawals in retirement)

Tax: £99,051

Net proceeds: £561,288

Which Strategy Might Suit You?

Difference = £177,948 more from the pension approach.

This is down to a higher level of growth compounding, which you would expect, but also a much more beneficial tax rate on the way in and better on the way out.

What do I do now?

It is clear from the figures that putting excess profits into pension is the most tax efficient route for most business owners, and even more so for those businesses who do not qualify for BADR when they sell, such as some companies involved in property.

If you put money into pension, you need to work out how to invest it and how much risk to take.

You also need to be aware that you won't be able to draw it all out as one lump sum at retirement without being heavily taxed.

Whereas if you take it all out as a lump sum from the business at the point of sale, you then need to decide what to do with it.

For some people that flexibility is useful, for others it proves a challenge to work out where to put it, to provide the required income for whatever comes next, probably retirement.

Action - work out whether you would prefer to keep it in the business or put it into a pension. Either way, you need to make sure it is working for you and is growing or earning interest!

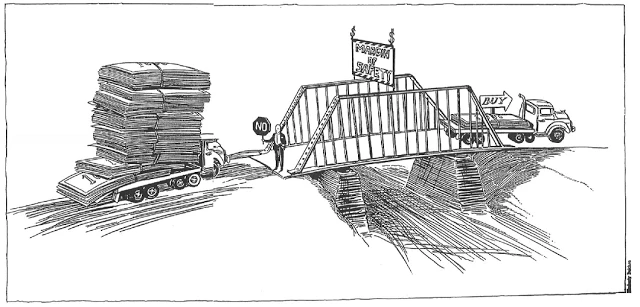

The bigger risk for most business owners isn’t choosing the “wrong” option with their profits.

It’s making perfectly sensible decisions in isolation, and only realising years later that they limited their future choices.

Whether any of the four options we've outlined are right for you depends less on the option itself, and more on how joined‑up your overall planning is.

That’s why we created a short quiz to help business owners sanity‑check how tax‑efficient their current approach actually is, both now and in the future.

🚨 Take our free quiz - see how tax-efficient you are 🚨

We've designed a quiz to help you understand how tax-efficient you're being, both in the short-term and long-term.

Try it here and get personalised results for what you should do next, plus get our free guide 'The Business Owner's Guide to Financial Independence'.

Jamie is Lab Financial Planning Managing Director, and a Certified Financial Planner™.

He advises business owners to help with their tax-efficient financial planning, and ensuring that they and their family are well protected, in any scenario.

If you'd like to discuss your financial planning, why not get in touch to see if we can help?

Remember, there are no stupid questions. Everyone has a different level of knowledge about money and planning their finances. We speak in plain English to help take away the fear and empower you to use your money well.

You can drop Jamie an e-mail here: jamie@labfp.co.uk

Or, you can book in a free introductory call, to discuss your situation, here: https://calendly.com/labfp/intromeeting

The information contained within this blog post should not be taken as financial advice, as it does not take account of personal circumstances, which would affect advice given. Should you wish to talk to us about personalised advice for you, we'd be happy to do so.

Tax rates are based on the tax year 2025/26.

FAQ

Q: What’s the difference between taking profits as salary vs dividends vs pension?

Salary

Subject to income tax and National Insurance (both employee and employer).

Corporation tax relief is available, but NI makes it the least tax-efficient way to extract profits beyond a modest level.

Often used up to the personal allowance or NI thresholds for state pension purposes.

Dividends

Paid from post-corporation tax profits.

No National Insurance, but dividend tax applies (after the £500 dividend allowance).

Flexible and popular for income, but not tax-deductible for the company.

Pension contributions

Paid by the company as an allowable business expense, reducing corporation tax.

No income tax or NI on contribution.

Money is locked away until later life, but typically the most tax-efficient way to extract surplus profits for long-term wealth.

In practice: most business owners benefit from a blend, using salary and dividends for lifestyle income, and pensions for long-term planning and tax efficiency.

Q: How does Business Asset Disposal Relief affect my profits on sale?

BADR reduces the capital gains tax payable when you sell or close your company, but only at that point in time.

BADR applies a reduced capital gains tax rate (currently higher than it used to be) on qualifying business disposals.

It only applies when you sell shares or wind up the company, not while profits remain inside it.

You must meet conditions around shareholding, employment, and trading status.

BADR is not guaranteed forever. Rates and rules have changed before and may change again.

The key planning point: Leaving profits in the business means deferring tax, not avoiding it, and accepting political and legislative risk along the way.

Q: Can I leave profits in the company indefinitely?

Yes. But it’s rarely the optimal long-term strategy on its own.

You can legally retain profits in your company for many years, but there are trade-offs:

Pros

Flexibility and control

Funds available for reinvestment or future planning

Potential access to BADR on exit

Cons

Cash may grow slowly compared to pensions or diversified investments

Exposure to future tax rule changes

Company risk (creditors, trading risk, legislative changes)

Eventually, tax is usually paid when profits are extracted or the business is sold

For many owners, the better question isn’t “Can I leave profits in the company?” but“Which profits should stay in the company and which should be moved out, and how?”

These decisions rarely exist in isolation. The right answer depends on your income needs, growth plans, exit strategy and long-term goals.

This is exactly what good financial planning for business owners is designed to solve.