- Jamie Flook

- Oct 24, 2025

- 5 min read

(and Why Flexibility Is Your Real Financial Superpower)

Perhaps I should start by saying: this isn’t the way to think about debt — it’s just how I think about it.

But maybe, after reading this, you’ll think a little differently too.

They say there are are no new ideas under the sun, and this one owes a nod to something I once read from Morgan Housel - my absolute favourite non-fiction writer - for the way he communicates big, and sometimes complicated, money concepts.

His thinking helped shape how I view debt. To view it not just as a financial instrument, but as something that quietly reshapes the way we experience life.

Why Debt Narrows Your Future

When most people think about debt, they think about numbers.

The interest rate. The monthly payment. Whether it’s “cheap” or “expensive.”

And that’s fair enough, those things matter. Debt, after all, isn’t inherently bad. Used wisely, it can be a powerful tool.

Mortgages, business loans, even student debt, these can all unlock opportunities that would otherwise be out of reach. Some call it using leverage.

But there’s a hidden cost that rarely gets talked about. One that isn’t measured in pounds or percentages. Debt doesn’t just cost money.

It costs flexibility.

And that flexibility is what determines how much of life you can comfortably handle when things don’t go to plan.

The Hidden Cost: Flexibility

Imagine your life as a squiggly line, like a stock market chart. Yes, you can picture it, going up and down over time. Sometimes you're up, and sometimes you're down.

Those ups and downs represent the natural volatility of life: promotions, redundancies, illnesses, family events, unexpected moves, market crashes, political curveballs, even moments where you simply change your mind about what you want.

Now, picture a band or “channel” surrounding that line, above and below it.

That band represents how much volatility you can handle before things start to go wrong.

When you carry little or no debt, that band is wide, like you can see illustrated here.

You could lose your job for six months and recover.

You could move cities, take time off, or make a career change without breaking.

But as you take on more debt, that band narrows.

A six-month job loss becomes unaffordable after three.

The roof on your home leaking and needing to be replaced was once manageable, but now becomes catastrophic.

The flexibility to adapt, to handle life’s inevitable surprises, starts to disappear.

At high levels of debt, even small disruptions can become existential threats.

That’s true for individuals, businesses, and even entire countries.

How To Think About Debt: Why This Matters

Volatility isn’t a theoretical risk, it’s reality.

I'm not sure when you felt it, but for me it was 2016. Trump getting in power in the U.S. and the Brexit vote here in the U.K. signalled the end of the something. The world has, by common consensus, become more volatile.

Over the next 10, 20, or 30 years, the odds that you’ll experience at least one of the following are 100%:

A recession

A health issue (your's or someone close to you)

A political or economic shock

A family emergency

A major life change

The most dangerous thing about debt isn’t the interest rate. It’s that it reduces your ability to respond to the unexpected.

There’s a reason some Japanese businesses have lasted over 500 years. Researchers studying these ultra-resilient firms often find one common trait: they carry little or no debt, and they hold plenty of cash.

That’s how they’ve survived wars, recessions, natural disasters, and regime changes. They weren’t the most aggressive or leveraged companies, they were simply the most adaptable.

And adaptability is everything. I don't know what's going to happen tomorrow. Hell, I don't even know what's going to happen today, do you?

The Real Asset: Optionality

At its core, managing your financial life, personally or professionally. It is about one thing: having options.

The ability to make changes, endure setbacks, or take advantage of opportunities when they arise.

Debt restricts those options.

That doesn’t mean you should never borrow. Used carefully, debt can be constructive. But next time you consider taking some on, try asking a different question.

Instead of:

“Can I afford the payments?”or “Is the rate low?”

Ask:

“How much flexibility am I giving up by doing this?”

Because that’s the real cost. And in an unpredictable world, flexibility is arguably your most valuable asset.

Planning With a Margin of Safety

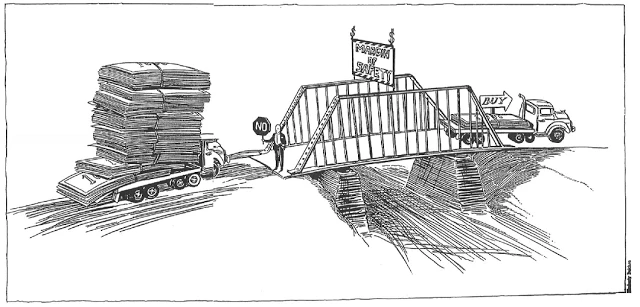

In engineering, a margin of safety means designing a bridge to hold 30 tonnes, even if the heaviest expected load is only 10.

Why? Because uncertainty exists. Maybe the materials weaken. Maybe two trucks arrive at once.

The margin of safety exists not because failure is likely, but because it’s possible.

In financial planning, the principle is exactly the same.

A margin of safety is the buffer between what you expect and what you can endure.

It’s the gap between your income and spending, your projected investment returns and your real needs, your risk tolerance and your resilience.

And the further you stretch yourself, financially, emotionally, or logistically, the smaller that margin becomes.

What It Looks Like in Practice

Save more than you think you’ll need.

Markets don’t always behave, and life doesn’t follow spreadsheets.

Live below your means. Not for the sake of frugality, but to give yourself room for the inevitable curveballs: redundancy, illness, helping family.

Invest with realistic expectations. Plan for 5% returns even if long-term averages are 7%. That 2% gap is your safety margin.

Hold some cash. It won’t earn much, but it buys you time. And time is flexibility.

The biggest financial risks aren’t always the obvious ones. They’re the surprises, the things you didn’t see coming or couldn’t predict.

A margin of safety protects you from those blind spots. It’s not pessimism, it’s realism.

Optionality Is the Real Wealth

To me, true wealth isn’t about having more money. It’s about having more options.

The freedom to walk away from a rubbish job. To take a sabbatical. To help a family member. To sleep well at night.

A margin of safety protects those options.

Without it, small disruptions become big problems.With it, big disruptions become survivable.

Having a margin of safety in your financial plan isn’t a lack of confidence, it’s an act of humility.

It’s saying:

“I don’t know what the future holds, but I know it won’t go exactly according to plan.”

And that mindset, more than any number on a spreadsheet, is what creates lasting financial wellbeing.

Jamie is Lab Financial Planning Managing Director, and a Certified Financial Planner™. He advises business owners and makes sure that their money, life and business are aligned in working towards their goals.

If you feel like you need help with your financial planning, why not get in touch to see if we can help?

Remember, there are no stupid questions. Everyone has a different level of knowledge about money and planning their finances.

We speak in plain English to help take away the fear and empower you to use your money well.

You can drop Jamie an e-mail: jamie@labfp.co.uk

Or, you can book in a free introductory call, to discuss your situation, here: https://calendly.com/labfp/intromeeting